Note 23: Stonk Talk

Tendies and time machines.

It would be a cracking start to the year and so very 2021 if a subreddit triggered the post-Covid financial collapse by short squeezing fucking GameStop.

Posted by Happy Dave at 1:04 PM on January 26

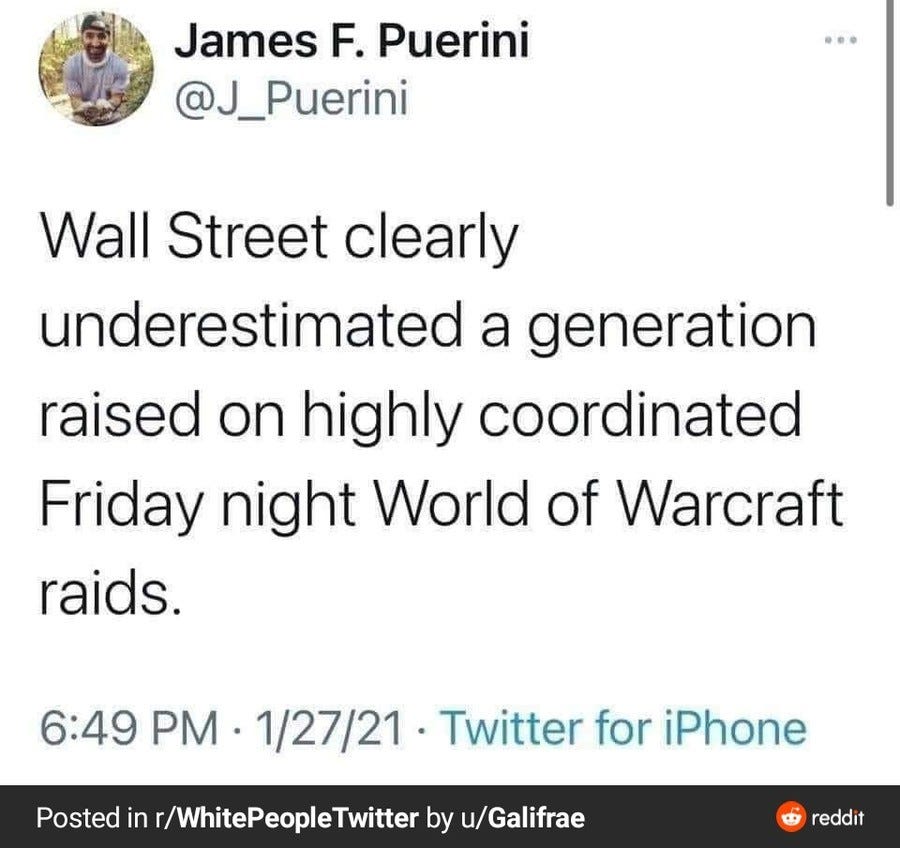

WE CAN REMAIN RETARDS LONGER THAN THEY CAN REMAIN SOLVENT

u/SDBcop @ reddit.com/r/WallStreetBets on January 25th

Last week, I was swept up by the whole GameStop kerfluffle. I caught wind of it the week before last, and was chatting with folks about it into the weekend, and then things went nuts last Monday, and I was transfixed by the spectacle. For folks looking for an explainer article, The Verge has done a decent job with one.

I was content to watch from the sidelines, but on Wednesday (only a week ago!), my own holdings of AMC, Nokia, and Virgin Galactic were caught up in the maelstrom as Redditers (presumably) wanted to use their newfound power to find other opportunities for making more tendies.

I detailed my rationale in more detail about why I picked up AMC, NOK, and SPCE in an earlier newsletter, but for folks who don’t remember that, I sunk a fraction of my 2019 retirement contributions into those companies as side-bets to my larger investments in larger index funds. See, I’m what they call a Boglehead, in that I subscribe to a long-term investment ethos where I feel downright guilty if I sell a stock before holding it for longer than the time I’d spend earning a new bachelor’s degree. It’s an approach that worked well for me so far (better than 10x returns over the past decade), so the GameStop battle was more a curiousity than anything I was seriously contemplating joining. (I figured that by the time I got excited about it, the good opportunities were already gone, and I would end up someone else’s Greater Fool.)

I was quite surprised when some of my own holdings were inflated by the GameStop traders, and I initially set up sell orders for the affected shares should they surpass 10 times the price I originally paid for them. (The goal is 10x growth, so if it happens in a few months, as opposed to several years, who am I to complain?) Of all the shares I purchased, AMC got the closest to being sold, while NOK pretty much did nothing after the initial bump, and SPCE jumped not from speculation, but from actual news that Richard Branson’s space planes would start flying again.

I had a couple of opportunities to cash in on some of the gains, but I wanted more for the stocks as they deflated than the market was willing to pony up. My $30 AMC sell order went down to $20, then down to $17.50, with no takers. As I write this, it looks like the situation has finally petered out, and my shares are drifting back to earth. I could be frustrated that I was too greedy (could have cashed with 5x returns on Monday if I wasn’t so certain that the market would throw more money my way), but on the other hand, my original justifications for owning those shares remains intact and the affected companies are fundamentally stronger than they were before I had heard of diamond hands, and I entertained brief fantasies of timing the market to my benefit.

Such is life.

Several questions

It’s remarkable to what extent the raid on the short sellers captured my attention over the past 10 days. Since politics and government are pretty boring these days (Thank Jeebus!), I guess I shouldn’t be surprised something would rush into fill the void. With that in mind, a couple lingering questions that stick with me:

1. Is this replicable?

Last week’s trading destroyed tens of billions of dollars in capital, while making plenty of people millionaires. The primary condition that lead to the rush into GME stocks was discovering that it was excessively shorted and moving quickly to take advantage of those short sellers.

As of writing, the morale of denizens of r/WallStreetBets seems to be pretty low, and I wonder whether this whole episode serves as a cautionary tale that prevents future episodes, or whether we’ll see this happen again in the future.

2. Are Elon Musk’s companies now invincible against short sellers?

One of the key accelerants of last week’s events was Elon Musk’s “#GameStonk!!” tweet. It injected some credibility into the trade and was a beloved figure (among the Reddit crowd) egging on his fans.

Gamestonk!!

— Elon Musk (@elonmusk) 9:08 PM ∙ Jan 26, 2021

reddit.com/r/wallstreetbe…

In the past, Musk has fought his own skirmishes with short sellers and emerged largely victorious. In the future, will the mere threat of Musk summoning the Reddit traders on his behalf serve as sufficient disincentive for traders looking to establish a short position in one of his companies?

3. New hunters in the financial Dark Forest?

The universe is a dark forest. Every civilization is an armed hunter stalking through the trees like a ghost, gently pushing aside branches that block the path and trying to tread without sound. Even breathing is done with care. The hunter has to be careful, because everywhere in the forest are stealthy hunters like him. If he finds other life — another hunter, an angel or a demon, a delicate infant or a tottering old man, a fairy or a demigod — there’s only one thing he can do: open fire and eliminate them. In this forest, hell is other people. An eternal threat that any life that exposes its own existence will be swiftly wiped out. This is the picture of cosmic civilization. It’s the explanation for the Fermi Paradox.

- Liu Cixin, The Dark Forest

The stock market - at least in the short term - resembles Cixin’s Dark Forest, especially when you throw automation and algorithms into the mix. Melvin Capital screwed up by letting their short exposures become known, and that’s what r/WallStreetBets jumped on.

Moving forward, will r/WallStreetBets become a robust crowdsourced player in their own right where companies whose shares exceed a certain shorted percentage attract the attention retail investors? Or will this example (assuming that it ends poorly for most involved), serve as an impediment for the community acting in a single concentrated direction as it did this time?

4. Astroturf?

Reading the community’s comments this week, there are quite a few folks accusing institutional bad actors as masquerading as forum members to bump other securities (notably silver) for institutional gains. As mentioned above, Musk may be in a position where he can leverage the community - can someone else exercise this kind of power pseudonymously? If so, to what extent does small retail investor messaging and propaganda become part of firms’ overall trading strategies? Is there an opportunity for selling services that raise a strategy’s reputation among Internet People, like we seen how business have adopted Facebook pages and other social media outreach?

5. Clawing back options and margin accounts from retail investors?

One of the strategies employed by the Reddit crowd was to boost their exposure to GME shares by trading options and using margin accounts. Until last week, Robinhood has been touting how they are bringing these features to retail traders (“Democratize finance!”). Given that its users in the last week jeopardized its financial stability, will we see a pull back of these features to “pro” tiers that require additional higher hurdles for investors to jump before access to these features are granted?

There are lots of interesting questions here, and I imagine quite a few theses and dissertations will be written in then next few years about last week. That said, I enjoyed the folks who drew a parallel between the battle between Reddit and the hedge funds, and the final battle of Ready Player One:

Book report

Three Days to Never by Tim Powers (★★★★☆): Tim Powers’ books are a treat. He has a consistent formula for crafting his novels, where he takes some obscure bit of history, scans it for holes, and fills in those holes with rolicking supernatural tales that leave you looking at the world a bit differently. Declare filled in bits of the Kim Philby mythos, Last Call patched Las Vegas gangster history with the Fisher King, and Three Days to Never situates the personal history of Albert Einstein (including his infidelities) in the context of three days in 1987’s southern California where a hapless literature professor finds himself in the middle of a hunt for a time machine, with Israel’s Mossad on one side, and the modern incarnation of a twelfth-century Grail cult on the other side. Add in an interesting take on light cones as elements of Grail symbology, splash in a bit of Tenet, and you have this Tim Powers story.

Look - if you’ve been reading these Notes long enough, you’ll already know that I’m a sucker for these kinds of secret history stories. No one writes them better than Powers, and this book would stand tall next to others writing in this tradition. Standing next to other Powers works, it’s certainly an acceptable entry into his canon, but its major issue was that it left some of its potential on the table. This is a pretty personal tale of a man and his daughter, and while the story is well-served by focusing on that relationship, it left a couple of fantastic things on the table, such as expanding what was going on at the Rephidim stone. But then again, history isn’t a tidy tapestry, so it’s probably not fair for me to fault Powers for leaving a few loose threads for us to ponder.

At this point, I’m 1 book ahead of schedule (10 of 100).

Interesting reads

Mayor Aims to Turn Small Town Into QAnon, USA (The Daily Beast)

The New National American Elite (Tablet)

The Running With Scissors Party (Jonah Goldberg)

A 25-Year-Old Bet Comes Due: Has Tech Destroyed Society? (Wired)

Until the next point where our timelines intersect, o7 CMDRs.